10 EASY Savings Challenges That Will Help You Save THOUSANDS [FREE PRINTABLE]

Saving money isn’t always the most exciting thing, one of the best ways to stay motivated to save is savings challenges! I am a very competitive person and if I can make a game out of saving money, it makes me work that much harder.

Today I’m sharing my top 10 savings challenges that will keep you pushing for more resulting in great returns!

Before we jump in, WHERE you keep your savings is also very important. The best place to keep your savings is a high-yield savings account so that you can be earning interest on your money. CIT Bank offers record-breaking interest rates. Click here to open an account!

All of these savings challenges can also be used for debt payoff or putting it towards your investments. They are all totally customizable for whatever financial goal you are working towards.

Check out this video for even more detail on these savings challenges!

Challenge a Friend Savings Challenge

Not many things will push you harder than making a competition out of it!

With the Challenge A Friend savings challenge printable, you can challenge a friend to work towards the same goal as you.

It’s customizable for any amount and has you set a prize at the end, it could be the loser has to cook dinner or simply bragging rights!

Find LESS EXPENSIVE Alternatives

One of the biggest expenses that many people have each month is their cell phone bill. But did you know that you can save a lot of money by switching to a less expensive cell phone carrier?

If you’ve ever thought “Why is my wireless bill so high” then let me tell you about my partner Mint Mobile, who I’m partnering with today.

Hear me out… when we think of switching our cell phone provider we think it’s going to be super complicated.

Can I keep my number? Do I have to get a new phone?

The great news is you can keep your current device, phone number, and easily switch services. It’s not complicated at all and you can save a TON of money.

How much are you paying right now for your cell phone bill a month? I bet you, it’s way too high!

Switch to Mint Mobile today and pay as low as $15 a month and you don’t have to sacrifice any coverage, speed, or data.

Mint Mobile is built on the nation’s largest 5G network and they keep costs low because they sell directly to you online – they cut out the retail stores and salespeople.

Switching to Mint Mobile is super easy. Here’s how amazing they are and what they offer:

- Digital eSIM cards, you can sign-up and activate them immediately right on your phone from the comfort of your home.

- Unlimited nationwide talk and text, plus lightning-fast 5G and free mobile hotspot.

- Mint Mobile will show you how much data you use each month and recommend plans that save you money.

- Mint also offers a Modern Family Plan that lets you set up a super affordable family plan with as little as two lines.

Stop paying more than you need to on your wireless bill and start saving BIG with Mint Mobile.

What are you waiting for?!

>> Click here to get premium wireless starting at $15 a month!

$1,000 In 30 Days Challenge

Saving $1,000 in 30 days is not for the faint of heart but it’s an awesome challenge if you are!

Everyday color in an icon and transfer that amount to your savings. At the end of the 30 days, you will have saved $1,000! (This can also be used for debt payoff as well!)

The best part about this challenge is the savings don’t have to go in order. If you have a day where you made a lot in tips or got a bonus at work you can tackle one of the higher savings days, and if you had a low day you can save as little as $5.

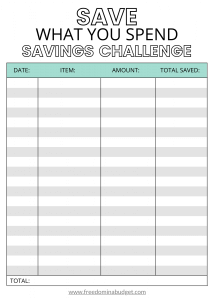

Save What You Spend Challenge

The Save What You Spend Savings Challenge not only helps you to save money but also stay accountable to your spending habits.

Here’s how it works: choose a spending category like eating out, personal spending money or clothing.

Then every time that you spend from that category you have to transfer the SAME amount to savings. For example, if you spend $11 on lunch with your coworkers then you also transfer $11 to your savings. If you can’t afford the $22 for lunch, then you don’t spend it!

$5 Dollar Savings Challenge

Handy Save $5 saving challenge printable. This useful finance printable will help you to gradually save $500 by saving every $5 bill you receive!

Saving over $500 may sound really hard, especially if you aren’t used to saving money. The $5 Bill Savings Challenge helps you to gradually save up the money to reach your goal of $500.

More Ways To Save:

Here at Freedom In A Budget, I am all about saving money! Here are some of the EASY ways that I save money:

• CIT Bank offers high interest savings accounts and CDs to provide a safe, secure way to earn money grow your savings.

• Rakuten/Ebates: Rakuten is my to go way to earn Cash Back from over 2,500 stores like Macy’s, Amazon, Sephora, Walmart and much more. Join Rakuten today for free, and you’ll get a $10 Cash Bonus to get you started! Every three months, you’ll get a Big Fat Check in the mail or a PayPal payment just for shopping.

• M1 Finance is an easy to use brokerage platform that allows you to invest in Fractional Shares and auto reinvest!

• Budget Templates: Excel budget templates with pre-populated categories and formulas to keep you on track with hitting your financial goals.

$1,000 Challenge Printable!

Handy Save $1,000 money-saving challenge printable. This useful finance printable will help you to gradually increase your savings over whatever timeframe you choose. Use this tracker and save $1,000!

Saving over $1,000 may sound really hard, especially if you aren’t used to saving money. The Savings Challenge helps you to gradually save up the money to reach your goal of $1,000. The first day you are only saving $5! Yep, that’s right, only $5! I know you can hit that goal!

$1,000 Debt Payoff Tracker Printable

A Debt Payment Tracker to help keep you motivated while you are paying off debt! Having a visual tracker helps to keep you motivated while paying off debt. Color in an icon each time you hit a new milestone, once the tracker is complete you will have paid off $1,000!

Print as many times as you want for each $1,000 of debt that you have. Tackling your debt in small, manageable chunks helps to keep you motivated and not overwhelmed!

Net Worth Tracker

Tracking your net worth each month helps you to get a clear view of your finances and is extremely motivating to building wealth.

All of the formulas are pre-built, simply plug in your personal numbers and you are good to go!

What you track Monthly:

– Liquid cash (cash, savings, and checking accounts)

– Assets

– Investments

– Debt Payments

– Liabilities (mortgage, car)

The spreadsheet also calculates how much your net worth has grown each month!

One Month Ahead Savings Challenge

Saving one month of expenses may sound really hard, especially if you aren’t used to saving money… but it doesn’t have to be!

Use this easy printable to get One Month Ahead on your bills. Simply calculate your total monthly expenses, then divide that number by 30. Color in a calendar every time you save that amount.

Once all the calendars are all colored in you will have saved one month’s worth of expenses and be one month ahead on your bills!

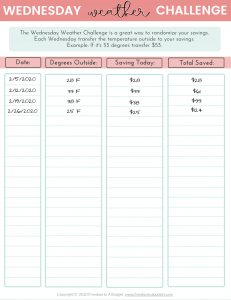

Wednesday Weather Challenge

The Wednesday Weather Challenge is a great way to randomize your savings. Each Wednesday transfer the temperature outside to your savings. Example: If it’s 53 degrees transfer $53.

Track Every Penny Challenge

Tracking every penny that you spend can sound really daunting but trust me, once you get into the habit it is second nature and really doesn’t take that long.

Every 2-3 days log into your bank accounts to access your statements, spend 5-10 minutes, and record every single expense into your budget. Here is the budget template that I use and what helped me pay off all my debt, cash flow my wedding, and buy my first house. Here are some tips on setting up your first budget.

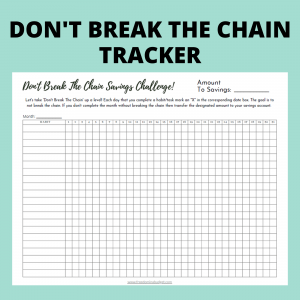

Don’t Break The Chain Savings Challenge Printable

Let’s take ‘Don’t Break The Chain’ up a level! Each day that you complete a habit/task mark an “X” in the corresponding date box. The goal is to not break the chain. If you don’t complete the month without breaking the chain then transfer the designated amount to your savings account.

52-Week Savings Challenge

Handy 52-week money-saving challenge printable. This useful finance printable will help you to gradually increase your savings over a 52 week period (1 year). Use this tracker and save $1,378 in one year! – Saving over $1,300 in a year may sound really hard, especially if you aren’t used to saving money.

The 52-Week Savings Challenge helps you to gradually save up money. In the first week, you are only saving $1! Yep, that’s right, only $1! I know you can hit that goal! The following week you save $2, the week after $3, halfway through the year you are saving $26 that week until you get to the last week of the year and save $52. At the end, you will have saved $1,378!!

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission. The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers. By using the affiliate links, you are helping support our Website, and we genuinely appreciate your support.

what do you think?

You must be logged in to post a comment.