8 Tips For Budgeting with an Irregular Income

Do you work on commission or have an irregular income where you make a different amount each month? If you have an irregular income, that means you can’t budget right? Nope!

Today, I’m walking you through step by step how to create a successful budget with an irregular income.

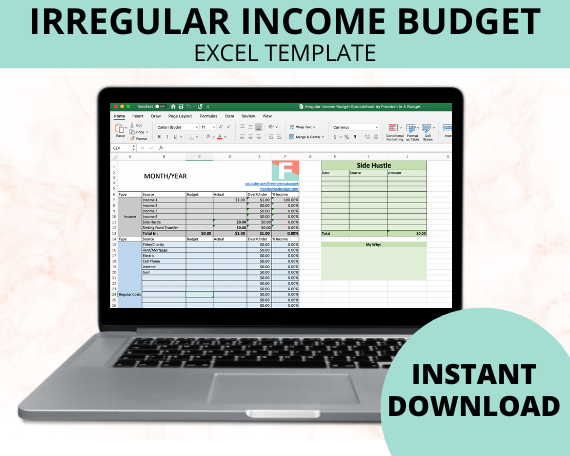

Irregular Income Budget Template

There are a few different steps that you need to take when creating a budget with an irregular income.

I’ve created a special budget template specifically for irregular incomes and commission-based incomes.

Spending Analysis

When creating a budget it’s important to know how much you are spending in each category. If you aren’t already budgeting you probably have no clue how much you are spending in groceries, gas, and personal spending money.

This is where a spending analysis comes in.

To do a spending analysis, grab this easy-to-use template, and open up your bank accounts and credit card apps.

Go through the last 3 or 6 months and put each purchase into a category.

The spending analysis template will do the math for you and tell you on average how much you are spending in each category.

Take these averages and plug them into your irregular income budget.

>> For more information, watch How To Do A Spending Analysis.

>> Get your own Spending Analysis Template here.

List your incomes

Figure out the lowest amount that you would be bringing in each month.

For example, if you have a commission-based job and have a base salary of $30,000 and then make a commission on top of that you would calculate your income on the $30,000.

Another option is to look at your paychecks for the last 6 months and create the budget based on the lowest paychecks.

Bare-bones budget

Next, fill out the irregular budget template and create a “bare-bones budget”.

A bare-bones budget is a budget with just the necessities. This is the budget you would go to if you lost your job and went into crisis mode.

Figure out just the necessities to live, such as your mortgage/rent, utilities, minimum payments on debt, basic groceries, gas for your car, etc.

This does not include eating out, personal spending, subscription boxes, or non-essential sinking funds (ones that are for annual payments are fine).

Also check out these articles:

ThriveCart Now Has a FREE Plan to Sell Your Online Courses

If you’ve been searching for the best checkout platform for beginners, how to sell digital products online, an affordable course platform, or a way to start selling without expensive software, ThriveCart’s free launch plan is exactly what you need.

It’s designed for creators, coaches, side hustlers, and online business owners who want to launch quickly using no code checkout pages, funnels, subscriptions, and built in course delivery, all-in-one system.

EASY Savings Challenges That Will Help You Save THOUSANDS [FREE PRINTABLE]

Saving money isn’t always the most exciting thing, one of the best ways to stay motivated to save is savings challenges! I am a very competitive person and if I can make a game out of saving money, it makes me work that much harder.

Today I’m sharing the ultimate list of savings challenges that will keep you pushing for more resulting in great returns!

In Season Produce by Month | How To Save Money On Groceries

Fresh fruits and vegetables can get expensive. One big way to save money is by buying your produce when it is in season.

Produce grows best at different times of the year depending on what type of fruit or vegetable it is. When you buy your produce during that time, it will save you money rather than the stores having to ship it in from another part of the country or world.

Extras for high-income months

If you have a commission-based job or irregular income, you will have high months and low months.

In the irregular income budget template, there is a section for these items.

When you have a month with a higher income, what are you going to put that money towards?

- Extra debt payments

- Investments

- Savings

- Date night

- Sinking Funds

It’s important to have these expenses pre-planned because when the big commission check comes it’s easy to go “LET’S CELEBRATE” and blow the whole check on frivolous items.

You can include fund things as well, such as “date night” but don’t let the entire category be fun things, it’s important to work towards your financial goals.

Track your expenses all month long

One of the biggest tips that I have with budgeting is to update your budget throughout the month.

I recommend adding in all of your new expenses every 3-4 days, at a minimum once a week.

Tracking your expenses throughout the month does three important things.

First, it only takes 5-10 minutes to stay on top of your budget. If you wait until the end of the month to track all of your expenses, it is going to take a long time and it will become a task that you dread.

Second, if you track your expenses throughout the month, you can quickly catch if you are going over budget in a category.

For example, if your grocery budget is $500 for the month, but after the second week, you see that you have already spent $400. Then you can reign in your spending, do a pantry challenge, and cut back. If you waited until the end of the month to track your expenses, it is too late and you overspent.

Third, it shows you what bills you have paid and what you haven’t paid yet.

If you are looking at your budget and notice that your electric bill is still blank in the spreadsheet, but it should’ve already hit your bank account, then you can go and make sure the card on file isn’t expired and avoid a careless late fee.

Update your income

If you budgeted for $3,000 and your ends up being $4,000, then it’s an extra $1,000 to work with and that is when you can use the section in the budget for “Extras for high-Income months”

- Extra $300 to the current debt you are working on

- Extra $200 to your sinking funds

- Extra $400 to your investments

- Extra $50 to eating out

- Extra $50 to fund the hills and valley fund

Hills & Valley Fund

When you have an irregular income or commission-based income, you have high months and you have low months of income.

Create a special fund called a “Hills & Valley Fund” for when you have those high and low months.

For example, if you are a server in South Florida and when it’s “in season” and all of the snow birds are here you income will be a lot higher, that is when you are on the “hill”.

Use this time to add more to your Hills & Valley Fund.

In the summer months, when income is lower and the snow birds have gone back to New York, it will be a “valley” and you can pull from this fund.

The hills and valley fund is in addition to your emergency fund.

I recommend keeping your emergency fund, sinking funds, and hills and valley fund in a high-yield savings account.

Create next month’s budget before the month is over

Before the month is over, create next month’s budget.

It will take you under 5 minutes to copy over and create next month’s budget. That way when the new month comes, your budget is ready to go.

>> Here is a video walkthrough on how to copy over your budget for the next month.

Ways to save!

- CIT Bank: BEST High-yield savings account; your bank shouldn’t be charging you money. Instead, YOU should be making money off your money!

- AURA: All-in-one digital safety to help protect you from identity theft, financial fraud, and online threats. Try AURA for 14 Days for FREE today and get 3 Bureau Credit Monitoring, Credit Lock, Antivirus, Secure VPN, Transaction Monitoring, Identity Protection, Parental Controls and 24/7 US-Based Customer Support.

- Ladder: Get a quick, free quote on term life insurance, affordable, online term life insurance. No exam! No waiting! No hassles!

- GetUpside: Earn 20 cents per gallon on gas cash back when you download the app and use code FIAB20.

- Fetch Rewards is a free grocery savings app that rewards you just for snapping pictures of your receipts. That’s it. Really. Free gift cards on groceries on thousands of products every day, no matter where you get your groceries. Just scan your receipts and get gift cards from retailers like Amazon, Target, Ulta, Applebees. Use code QHKBH to earn 2,000 points ($2)!

- GoodRx: Free app that provides you savings of up to 80% on your prescriptions (even if you don’t have insurance). $5 sign up bonus!

- Rakuten: Get cash back on online purchases and automatic coupons and savings with their browser plugin… and remember, you have to make a $20 purchase to get your $20 for free!

- Blooom: FREE 401(k) or IRA analyzer, Let the experts take a peek at your retirement account. Get real advice on how it’s doing and how it could be performing better.

- Lively: A modern health savings account. Prepare for tomorrow by making smart decisions about finances and healthcare today. Lively HSAs are free for individuals and families, so you never have to worry about hidden costs.

- Build Wealth by Investing in Index Funds Course: I’ve teamed up with my friend Jeremy from Personal Finance Club to teach you everything you need to know to invest in index funds! How to open an account, how much to invest, and how to choose an index fund. You’ll gain the knowledge and confidence to optimally invest and build wealth for decades.

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission. The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers. By using the affiliate links, you are helping support our Website, and we genuinely appreciate your support.

what do you think?

You must be logged in to post a comment.