Times are really tough right now. Inflation is through the roof and we are officially in a recession.

Today I’m sharing some easy, actionable steps that you can do to cut your bills in half.

Switch cell phone provider

Hear me out… when we think of switching our cell phone provider we think it’s going to be super complicated.

Can I keep my number? Do I have to get a new phone?

The great news is you can keep your current device, phone number and easily switch services. It’s not complicated at all and you can save a TON of money.

How much are you paying right now for your cell phone bill a month? I bet you, it’s way too high!

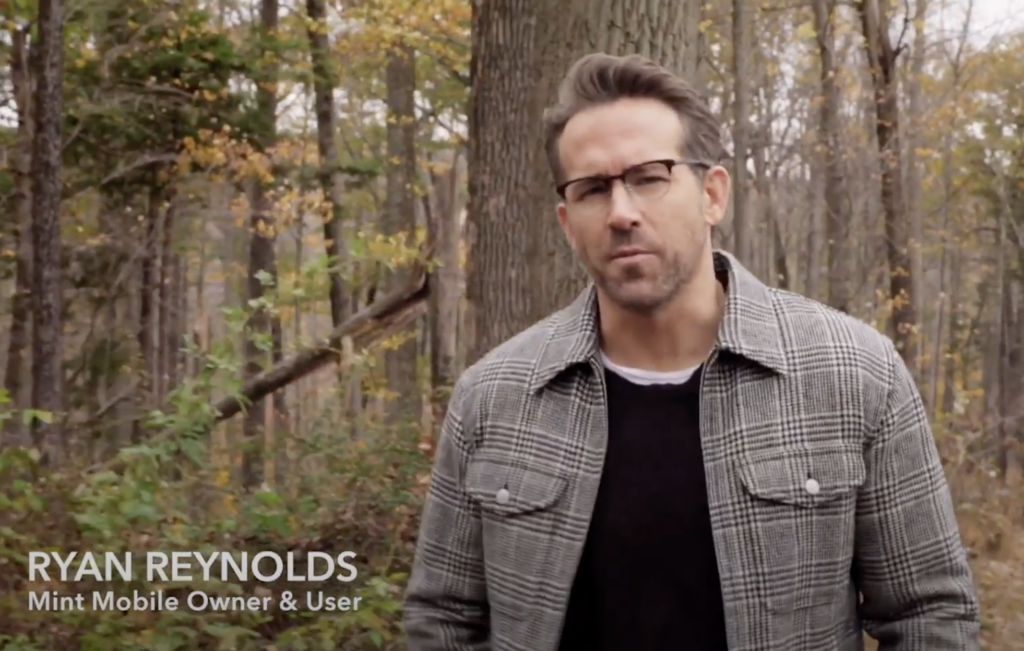

Switch to Mint Mobile today and pay as low as $15 a month and you don’t have to sacrifice any coverage, speed, or data.

That’s why I’m excited to partner with Mint Mobile.

Mint Mobile is built on the nation’s largest 5G network and they keep costs low because they sell direct to you online – they cut out the retail stores and salespeople.

Switching to Mint is super easy. Here’s how amazing they are and what they offer:

- Digital eSIM cards, you can sign-up and activate them immediately right on your phone from the comfort of your home.

- Unlimited nationwide talk and text, plus lightning-fast 5G and free mobile hotspot.

- Mint Mobile will show you how much data you use each month and recommend plans that save you money.

- Mint also offers a Modern Family Plan that lets you set up a super affordable family plan with as little as two lines.

Stop paying more than you need to on your wireless bill and start saving BIG with Mint Mobile.

What are you waiting for?!

>> Click here to get premium wireless starting at $15 a month!

Evaluate your subscriptions

Before we talk about subscriptions, we first need to talk about the importance of being on a written budget.

Being on a budget and tracking your income and expenses is vital for hitting your financial goals faster and cutting your expenses.

I recommend having a section in your budget, especially for subscriptions so that you can visually see how much you are spending each month. $7-$10 a month adds up fast when you have multiple subscriptions.

How to save money:

Do some research on the streaming services and the channels/shows they offer and pick one or two.

Here are my favorite services:

- Hulu: Save $20/month for 3 months on Hulu + Live TV, now with Disney+ and ESPN+.

- HBOmax: Now streaming blockbuster movies, epic originals, and addictive series. Plans start at $9.99/month.

- Showtime: 30-day free trial, then $10.99/month (also get $2 cash back with Rakuten)

- dish: Enjoy 2-year price guarantee, DVR with up to 2,000 hours of recording space, and 99% signal reliability. (also get $75 cash back with Rakuten)

- discovery+: The only streaming service with the greatest real-life entertainment from your favorite TV brands – including HGTV, Food Network, and more! Enjoy unlimited access to the greatest real-life entertainment, plus exclusives and originals.

- Roku: Thousands of hours, and counting, of content from the top names in music, movies, sports, and television. (also get 2.5% cash back with Rakuten)

- Amazon Prime Video: Watch Thousands of Movies & TV Shows Anytime with a 30-day free trial.

- Paramount+: 30-day FREE trial with SHOWTIME® for just $3/month more than Paramount+ alone. Watch hit originals, movies, docs, and sports, all in one place. Plus, SHOWTIME is always commercial-free!

This is also why it’s so important to have a written budget so you can see how much you are spending each month in your subscriptions.

Honest moment:

My husband and I have been guilty of signing up for a subscription service to watch one show and then forget to cancel it months later.

Add an event in your calendar to cancel the trial or subscription after you expect to finish the series.

Click here to get the same budget I’ve used to pay off my debt, pay cash for our wedding and save $50k in a year!

More ways to save!

- CIT Bank: BEST High-yield savings account; your bank shouldn’t be charging you money. Instead, YOU should be making money off your money!

- Ladder: Get a quick, free quote on term life insurance, affordable, online term life insurance. No exam! No waiting! No hassles!

- GetUpside: Earn 20 cents per gallon on gas cash back when you download the app and use code FIAB20.

- Fetch Rewards is a free grocery savings app that rewards you just for snapping pictures of your receipts. That’s it. Really. Free gift cards on groceries on thousands of products every day, no matter where you get your groceries. Just scan your receipts and get gift cards from retailers like Amazon, Target, Ulta, Applebees. Use code QHKBH to earn 2,000 points ($2)!

- GoodRx: Free app that provides you savings of up to 80% on your prescriptions (even if you don’t have insurance). $5 sign up bonus!

- Rakuten: Get cash back on online purchases and automatic coupons and savings with their browser plugin… and remember, you have to make a $20 purchase to get your $20 for free!

- Lively: A modern health savings account. Prepare for tomorrow by making smart decisions about finances and healthcare today. Lively HSAs are free for individuals and families, so you never have to worry about hidden costs.

- Build Wealth by Investing in Index Funds Course: I’ve teamed up with my friend Jeremy from Personal Finance Club to teach you everything you need to know to invest in index funds! How to open an account, how much to invest, and how to choose an index fund. You’ll gain the knowledge and confidence to optimally invest and build wealth for decades.

Call and negotiate your bills

Did you know that a simple 5 minute phone call to your cable or internet company can save you hundreds of dollars a year?

Don’t know what to say?

I’ve got you covered, follow this simple script to lower your bills.

When you first sign up for a new service you are most likely given a super low price to get you in the door.

As the 6-month or year-end contract ends, your bill gets higher and higher. You see ads on TV for that same company offering lower rates to new customers than to you, who is a LOYAL customer. That is just not right.

Use cash-back apps

We can’t get out of buying groceries, gas for our car or everyday household expenses, right?

Unfortunately not.

BUT… we can earn cash-back by simply scanning our receipts!

Sounds too good to be true right? It does, but it’s not!!

Here are my favorite cash back apps, I’ve been personally using them all for over 5 years!

Rakuten (formerly eBates)

Rakuten is the top app and desktop plugin for earning cash back on places that you already shop. They have an app as well as a chrome plugin that will ensure that you never miss a cashback deal.

How it works is when you shop at your favorite stores Rakuten will trigger that you went through them and give you a set amount of cashback!

If you sign up through this link and make your first purchase of $25 or more you will receive a $10 bonus!

*Note* You need to make a qualified purchase to receive your sign-up bonus of $10.

The best part is it will come to you directly through Paypal quarterly. They do have a feature where you can get a BOOST in your rebate if you redeem for a gift card!

>> Sign up for Rakuten here!

what do you think?

You must be logged in to post a comment.