Saving money is one of the most important aspects of personal finance, as it allows you to build a secure financial future, achieve your goals, and enjoy life without financial stress.

However, it can be challenging to figure out how to save money, especially in today’s world where there are so many temptations and expenses.

That’s why I’ve put together this article, which highlights 5 unique ways to save money and make the most of your financial resources.

Do a savings challenge

Saving money isn’t always the most exciting thing, one of the best ways to stay motivated to save is savings challenges! I am a very competitive person and if I can make a game out of saving money, it makes me work that much harder.

>> Check out this post with the Ultimate List of Savings Challenges!

Before we jump in, WHERE you keep your savings is also very important. The best place to keep your savings is a high-yield savings account so that you can be earning interest on your money. CIT Bank offers record-breaking interest rates. Click here to open an account!

All of these savings challenges can also be used for debt payoff or putting it towards your investments. They are all totally customizable for whatever financial goal you are working towards.

Challenge a Friend SavingsChallenge

Not many things will push you harder than making a competition out of it!

With the Challenge A Friend savings challenge printable, you can challenge a friend to work towards the same goal as you.

It’s customizable for any amount and has you set a prize at the end, it could be the loser has to cook dinner or simply bragging rights!

$1,000 In 30 Days Challenge

Saving $1,000 in 30 days is not for the faint of heart but it’s an awesome challenge if you are!

Everyday color in an icon and transfer that amount to your savings. At the end of the 30 days, you will have saved $1,000! (This can also be used for debt payoff as well!)

The best part about this challenge is the savings don’t have to go in order. If you have a day where you made a lot in tips or got a bonus at work you can tackle one of the higher savings days, and if you had a low day you can save as little as $5.

Try a meal delivery service!

Most people think that meal delivery kits are more expensive than groceries, but after a lot of research, I found that it’s not the case!

We all want to save money this time of year, but did you know that HelloFresh helps you save money all year-round? In fact, HelloFresh is cheaper than grocery shopping and 25% cheaper than takeout.

With HelloFresh, you get fresh, pre-portioned ingredients and seasonal recipes delivered right to your doorstep. Count on HelloFresh to make home cooking easy, fun, AND affordable – that’s why it’s America’s #1 meal kit!

Looking for an easy way to eat well and save money this year? Cut back on expensive takeout and delivery and get started with HelloFresh!

You’ll love how fast, easy, and affordable it is to whip up a restaurant-quality meal right in your own kitchen.

Helps you get out of the rut of cooking the same thing over and over and over again for dinner. With HelloFresh, eating well in the new year can be stress-free and delicious!

With over 35 weekly recipes, they have the options you’re looking for to help you achieve your goals. Choose Calorie Smart and Carb Smart recipes, or even customize select meals by swapping proteins or sides, upgrading your proteins, or adding protein to a veggie dish.

To try HelloFresh, just click the link below for 21 free meals plus free shipping and try HelloFresh today!

More ways to save!

- CIT Bank: BEST High-yield savings account; your bank shouldn’t be charging you money. Instead, YOU should be making money off your money!

- Ladder: Get a quick, free quote on term life insurance, affordable, online term life insurance. No exam! No waiting! No hassles!

- Upside: Earn 20 cents per gallon on gas cash back when you download the app and use code FIAB20.

- Rakuten: Get cash back on online purchases and automatic coupons and savings with their browser plugin… and remember, you have to make a $20 purchase to get your $20 for free!

- Lively: A modern health savings account. Prepare for tomorrow by making smart decisions about finances and healthcare today. Lively HSAs are free for individuals and families, so you never have to worry about hidden costs.

- How To Save Money On Groceries Course: Discover the Exact, Step-by-Step Plan to Cut your Grocery Budget to save TIME and MONEY. On sale for only $19!

Change your cell phone carrier

Hear me out… when we think of switching our cell phone provider we think it’s going to be super complicated.

Can I keep my number? Do I have to get a new phone?

The great news is you can keep your current device, phone number and easily switch services. It’s not complicated at all and you can save a TON of money.

How much are you paying right now for your cell phone bill a month? I bet you, it’s way too high!

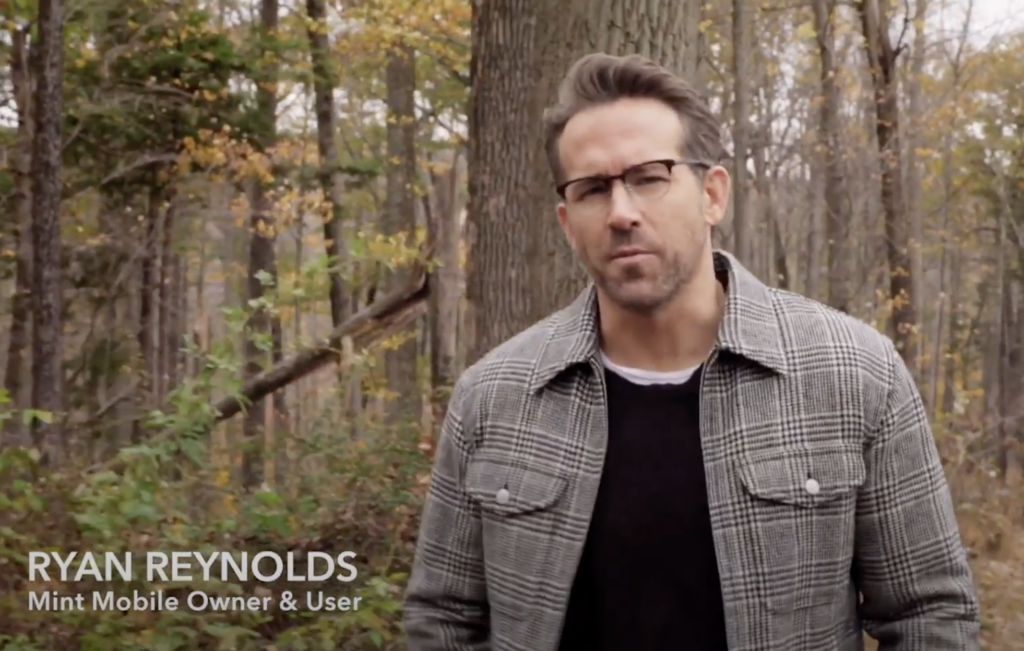

Switch to Mint Mobile today and pay as low as $15 a month and you don’t have to sacrifice any coverage, speed, or data.

That’s why I’m excited to partner with Mint Mobile.

Mint Mobile is built on the nation’s largest 5G network and they keep costs low because they sell direct to you online – they cut out the retail stores and salespeople.

Switching to Mint is super easy. Here’s how amazing they are and what they offer:

- Digital eSIM cards, you can sign-up and activate them immediately right on your phone from the comfort of your home.

- Unlimited nationwide talk and text, plus lightning-fast 5G and free mobile hotspot.

- Mint Mobile will show you how much data you use each month and recommend plans that save you money.

- Mint also offers a Modern Family Plan that lets you set up a super affordable family plan with as little as two lines.

Stop paying more than you need to on your wireless bill and start saving BIG with Mint Mobile.

What are you waiting for?!

>> Click here to get premium wireless starting at $15 a month!

Call and lower your bills

When you first sign up for a new service you are most likely given a super low price to get you in the door. As the 6-month or year-end contract ends you bill gets higher and higher. You see ads on TV for that same company offering lower rates to new customers than to you who is a LOYAL customer. That is just not right.

>> Here is a FULL script that you can use on the phone to help lower your bills.

The lower your bills, the more money you can put towards debt, savings, or investing!

Twice a year put it in your calendar to call the companies that charge your recurring bills: car/renter’s insurance, cell phone, and cable.

A budget helps you save money

Having a budget is a crucial tool in managing your money and saving effectively. A budget helps you track your income and expenses, so you can see exactly where your money is going each month.

By creating a budget, you can identify areas where you may be overspending and make changes to your spending habits.

A budget gives you control over your money

By creating a budget, you’ll have a clear understanding of your financial situation. You’ll know how much money is coming in and going out each month, and this information can help you make informed decisions about how to manage your money.

A budget helps you prioritize your spending

A budget forces you to think about where your money is going, and you can use this information to prioritize your spending. For example, you might decide that saving for an emergency fund or paying off debt is more important than buying expensive coffee or eating out regularly.

A budget avoids overspending

When you have a budget, you’ll know your limits, and this will help you avoid overspending. You’ll have a better idea of what you can afford to spend money on, and you can use this information to make smart financial choices.

A budget encourages saving

When you have a budget, you can set aside money for specific goals, like saving for a down payment on a home, investing for retirement, or building an emergency fund. By creating a budget and allocating money towards these goals, you’ll be able to save more effectively.

A budget increases financial awareness

Having a budget forces you to take a closer look at your spending habits and make adjustments as needed. By being more financially aware, you’ll be able to make better decisions about how to save and manage your money.

Add $100 to your mortgage

Did you know that adding $100 a month to the principal on your mortgage can save you $50,000 on your loan?!

In this video, I showed you on screen how to calculate your exact savings for your mortgage!

Don’t underestimate how much of a difference $100 can make!

In conclusion

As you can see, saving money is an important aspect of personal finance, and there are many unique ways to do it.

From savings challenges, to trying a meal delivery service, to adding $100 extra dollars to your mortgage or debt, there are many strategies you can use to make the most of your financial resources.

The key is to find what works best for you and make a plan to put it into action. With discipline, patience and a commitment to your financial goals, you can build a secure financial future and live life to the fullest.

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission. The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers. By using the affiliate links, you are helping support our Website, and we genuinely appreciate your support.

what do you think?

You must be logged in to post a comment.