2025 Tax-Free Weekends: The Smart Shopper’s Guide to Saving Big For Back To School

If you’ve got back-to-school, work-from-home, or everyday essentials on your list, tax-free weekends are the perfect time to shop smart and save even more. Many states offer limited-time sales tax breaks on things like clothing, school supplies, laptops, and even emergency prep gear.

But here’s where it gets really good, you can stack those savings.

Cashback apps like Rakuten often run extra promos during tax-free weekends. So while you’re skipping the sales tax at checkout, you might also get a few dollars back just for using a browser extension or shopping through your favorite store’s link. It’s a small step that adds up fast.

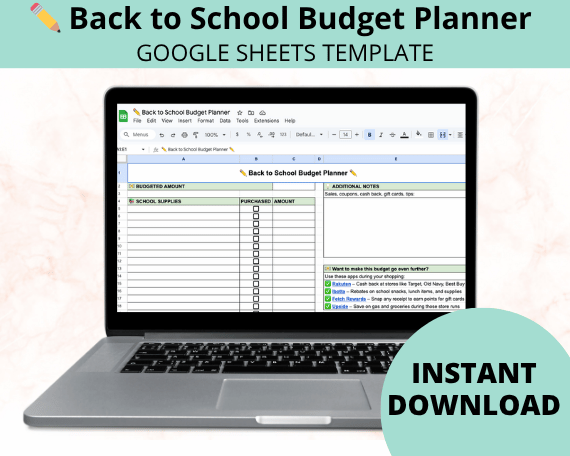

To make your shopping even smoother, I created two helpful tools:

A Google Sheets Back to School Budget Planner that auto-calculates totals as you shop

A Printable PDF version if you prefer to track it all by hand with pen and paper

Both are designed to help you stick to your budget, track what you’ve purchased, and avoid overspending.

In this guide, you’ll find:

Exact dates and rules for each participating state

Tips on what qualifies (and what doesn’t)

How to stack rewards using Rakuten, Ibotta, Upside, and Fetch Rewards

Smart shopping strategies to maximize every dollar

Let’s break it down by state so you know exactly what to expect, and how to make the most of it.

Earn Cash Back with Your Shopping

Before you grab your shopping list, do this one thing: Sign up for Rakuten.

Seriously. During tax-free weekends, stores are already dropping prices—and Rakuten lets you stack cashback on top of that. You could get 2%, 5%, even 10% back at stores like Walmart, Target, Best Buy, and Old Navy. It’s free. It works online and in-app. And it’s a no-brainer if you’re shopping anyway.

👉 Sign up here for Rakuten and get a welcome bonus when you make your first qualifying purchase.

Now, pair Rakuten with a few other free apps and you’ve got a money-saving dream team:

🛒 Ibotta – Get instant cashback on school snacks, office supplies, and tech gear. Scan receipts or link loyalty accounts.

📦 Fetch Rewards – Snap your receipts (literally any receipt) and rack up points to redeem for gift cards.

⛽ Upside – Driving store to store? Earn cash back on gas and groceries at participating locations.

👉 Download all 3 before your tax-free shopping trip. These apps run special promotions during back-to-school season—think bonus rewards, flash offers, and referral perks.

Double up. Stack smart. And keep more money in your wallet—even before the tax savings kick in.

Now, let’s break down the exact dates, what qualifies, and which states are offering the biggest savings this year 👇

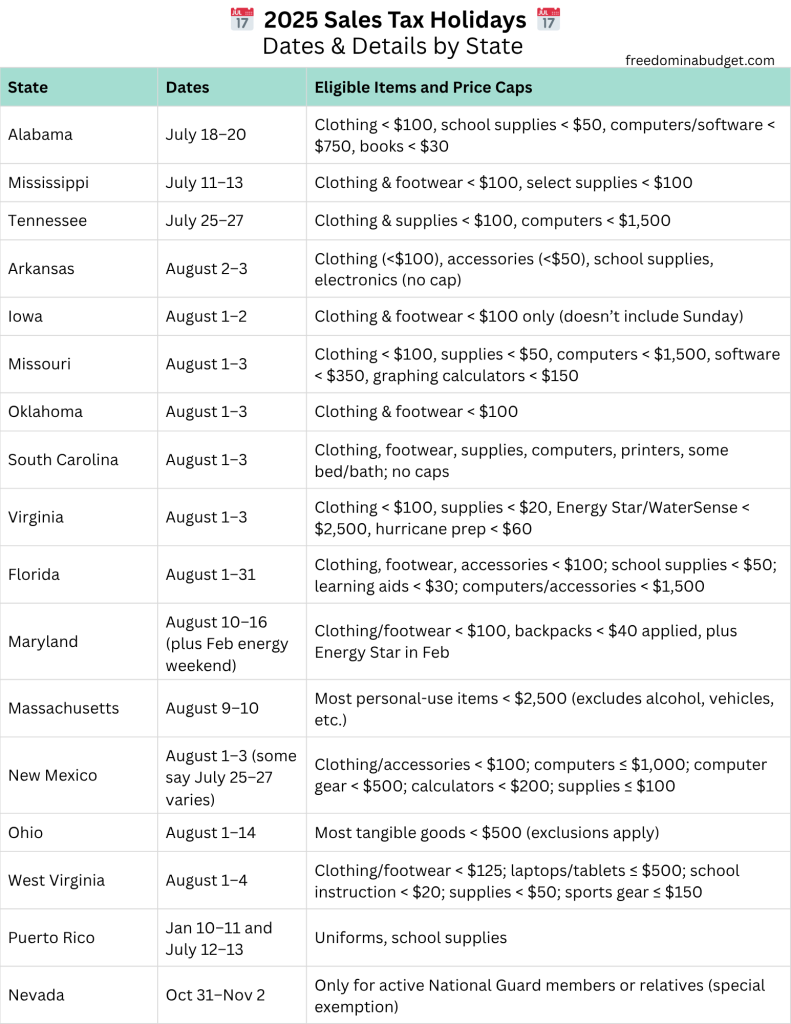

🗓️ State-by-State Guide to 2025 Tax-Free Holidays

Each state sets its own rules, so don’t assume what’s tax-free in one place applies everywhere. Some focus just on clothing and school supplies. Others include electronics, computers, hurricane prep, or energy-efficient appliances. And the price caps? They vary too.

Here’s a snapshot of what to expect so you can plan your shopping list accordingly.

🎒 How to Create a Back-to-School Budget That Actually Works

Creating a back-to-school budget doesn’t have to be complicated or time-consuming. Whether you love using spreadsheets or prefer good old pen and paper, I’ve got you covered with two easy-to-use tools:

🖥️ Google Sheets Budget Planner

This digital version is perfect for tracking your spending in real time. The spreadsheet is fully editable, with built-in formulas that total your spending automatically and show how much of your budget is left.

👉 Click here to get the Google Sheets Planner

🖨️ Printable PDF Budget Worksheet

Prefer to write things out by hand? The printable version gives you the same simple structure—just grab a pen and start checking things off as you shop.

👉 Click here to get the Printable PDF

✏️ How to Use the Templates to Write Your Back-to-School Budget

Here’s how to make the most of either version:

Start by setting your total budget.

Decide how much you’re able or willing to spend for the back to school season. Write this at the top of the planner.Break your budget into categories.

The template includes six sections:School Supplies

Clothing

Tech and Electronics

Lunch and Snack Gear

Backpacks and Bags

Extras and Fun Stuff

List out every item from your school’s supply list.

Whether it’s pencils, binders, uniforms, or a new laptop, enter each item in the proper section. Use the checkboxes to track what you’ve already purchased so nothing gets forgotten or double-bought.Estimate your spending.

Add in your best guess for what each item will cost and compare it to your total budget. If one category looks too high, adjust before you start shopping.Track your actual spending.

As you shop, fill in what you actually paid. In the Google Sheets version, your totals will update automatically. In the printable, simply subtract from your running total.Use the Notes section to stretch your budget.

Jot down coupon codes, sales you want to check out, or cash back app rewards. I even included tips for stacking savings with Rakuten, Ibotta, Fetch Rewards, and Upside.

By writing out your budget ahead of time, you’ll shop with confidence, avoid overspending, and have a much smoother back-to-school season. Grab the template that fits your style and get started today!

Spending Analysis

When creating a budget it’s important to know how much you are spending in each category. If you aren’t already budgeting you probably have no clue how much you are spending in groceries, gas, and personal spending money.

This is where a spending analysis comes in.

To do a spending analysis, grab this easy-to-use template, and open up your bank accounts and credit card apps.

Go through the last 3 or 6 months and put each purchase into a category.

The spending analysis template will do the math for you and tell you on average how much you are spending in each category.

Take these averages and plug them into your irregular income budget.

>> For more information, watch How To Do A Spending Analysis.

>> Get your own Spending Analysis Template here.

Also check out these articles:

ThriveCart Now Has a FREE Plan to Sell Your Online Courses

If you’ve been searching for the best checkout platform for beginners, how to sell digital products online, an affordable course platform, or a way to start selling without expensive software, ThriveCart’s free launch plan is exactly what you need.

It’s designed for creators, coaches, side hustlers, and online business owners who want to launch quickly using no code checkout pages, funnels, subscriptions, and built in course delivery, all-in-one system.

EASY Savings Challenges That Will Help You Save THOUSANDS [FREE PRINTABLE]

Saving money isn’t always the most exciting thing, one of the best ways to stay motivated to save is savings challenges! I am a very competitive person and if I can make a game out of saving money, it makes me work that much harder.

Today I’m sharing the ultimate list of savings challenges that will keep you pushing for more resulting in great returns!

In Season Produce by Month | How To Save Money On Groceries

Fresh fruits and vegetables can get expensive. One big way to save money is by buying your produce when it is in season.

Produce grows best at different times of the year depending on what type of fruit or vegetable it is. When you buy your produce during that time, it will save you money rather than the stores having to ship it in from another part of the country or world.

🛍️ What Qualifies (And What Doesn’t)

Not everything is fair game, even during a tax-free weekend. Every state has its own list of approved items, and more importantly, price limits.

Here’s a quick breakdown of common categories and how to shop them wisely:

✔️ Clothing

Most states include everyday clothing and footwear under a set dollar amount, usually around $100 per item. Think jeans, sneakers, jackets, and uniforms.

🚫 What’s not included: jewelry, handbags, sports gear, or protective equipment like helmets or cleats.

✔️ School Supplies

This covers basics like notebooks, pens, binders, art supplies, and calculators. Some states allow backpacks and lunch boxes too.

Watch for a per item cap, often between $20 and $50 depending on where you live.

✔️ Technology

In states like Florida, Missouri, New Mexico, and Tennessee, you’ll find tax breaks on laptops, tablets, printers, and even software.

Make sure your tech purchases stay under the total cap, which ranges from $500 to $1,500 depending on the state.

✔️ Emergency Prep and Energy Efficiency

Virginia and Maryland often include Energy Star appliances or hurricane prep supplies. Think flashlights, batteries, generators, tarps, and storm shutters.

Pro tip: These categories are great for homeowners and usually overlooked.

💰 Stack Your Savings Like a Pro

You’re already saving on tax, but this is where the real magic happens.

📱 Use cashback apps

Rakuten for major retailers online

Ibotta for snacks, school lunch items, and office basics

Fetch Rewards for scanning receipts from any store

Upside for gas and groceries if you’re driving to shop

You can use all four of these together. Grab a spiral notebook for school? Scan the receipt with Fetch. Link your Target or Walmart account to Ibotta. Activate your Rakuten cashback before you check out. Fill your tank with Upside on the way.

Small steps, big payoff.

🧾 Smart Shopping Tips

Know your limits. Price caps are per item, not per transaction. A $101 jacket? Taxable. Two $99 jackets? Probably fine.

Shop early. In-demand items sell out fast, especially electronics and name-brand supplies.

Use store pickup. Lock in deals during the tax-free window and skip the chaos in store.

Check if shipping counts. Some states factor in delivery fees. If your $99 backpack costs $10 to ship, it might bump over the cap.

Print or screenshot your state’s approved list. Just in case there’s confusion at checkout.

Increase Your Income: Start a Side Hustle That Fits You

When your income is unpredictable, cutting expenses can only take you so far. At some point, you need more coming in—not just less going out.

That’s where a side hustle can change the game.

And I’m not talking about selling random stuff online or chasing trendy apps. I teach women how to build online income streams that actually align with their skills, lifestyle, and values—so they’re not burning out or juggling a dozen things that don’t make sense for their season of life.

Whether it’s freelancing, virtual assistance, digital products, or coaching, there is a side hustle that’s right for you. The key is choosing one that’s realistic, not overwhelming, and actually profitable.

👉 Need help figuring out where to start?

Grab my free guide: “Figure Out Which Side Hustle is Best for You”

It walks you through exactly how to choose something that fits your life and helps you bring in consistent extra income.

Download it here and take the guesswork out of getting started!👇🏻

Ways to save!

- CIT Bank: BEST High-yield savings account; your bank shouldn’t be charging you money. Instead, YOU should be making money off your money!

- AURA: All-in-one digital safety to help protect you from identity theft, financial fraud, and online threats. Try AURA for 14 Days for FREE today and get 3 Bureau Credit Monitoring, Credit Lock, Antivirus, Secure VPN, Transaction Monitoring, Identity Protection, Parental Controls and 24/7 US-Based Customer Support.

- Lantern: Get a quick, free quote on term life insurance, affordable, online term life insurance. No exam! No waiting! No hassles!

- Upside: Earn 20 cents per gallon on gas cash back when you download the app.

- Fetch Rewards is a free grocery savings app that rewards you just for snapping pictures of your receipts. That’s it. Really. Free gift cards on groceries on thousands of products every day, no matter where you get your groceries. Just scan your receipts and get gift cards from retailers like Target, Ulta, Applebees.

- Rakuten: Get cash back on online purchases and automatic coupons and savings with their browser plugin… and remember, you have to make a $30 purchase to get your $30 for free!

- Build Wealth by Investing in Index Funds Course: I’ve teamed up with my friend Jeremy from Personal Finance Club to teach you everything you need to know to invest in index funds! How to open an account, how much to invest, and how to choose an index fund. You’ll gain the knowledge and confidence to optimally invest and build wealth for decades.

Common Questions about Tax Free Weekend for Back To School

What is tax-free weekend?

Tax-free weekend is a short period when states waive sales tax on certain items like clothing, school supplies, and electronics. It’s designed to help families save money on back-to-school and seasonal purchases.

Which states have tax-free weekend in 2025?

States like Florida, Texas, Tennessee, Ohio, and Massachusetts are participating in 2025. Each state sets its own dates and rules, so check your local schedule before shopping.

What items qualify for tax-free weekend?

Common items include clothing, school supplies, and electronics, depending on the state. Most states have price caps that determine whether the item is eligible.

Does tax-free weekend apply to online shopping?

Yes, many states allow online purchases to qualify if the order is placed within the approved dates. The shipping destination usually must be within the participating state.

Is there a spending limit for tax-free weekend?

Yes, states set per item price limits—often around $100 for clothing and up to $1,500 for electronics. Anything over the limit may still be taxed.

Do shoes count for tax-free weekend?

Yes, shoes are usually included in the clothing category as long as they meet the price requirement. Specialty shoes like cleats or protective footwear may be excluded.

Can I use coupons during tax-free weekend?

Yes, store and manufacturer coupons are allowed and can help lower the item’s price below the tax-free threshold. This can make more expensive items eligible for the exemption.

Does shipping count toward the tax-free limit?

In some states, shipping costs are added to the item’s total price and may affect eligibility. Be sure to review how your state handles shipping when shopping online.

What stores participate in tax-free weekend?

Most major retailers, both in-store and online, automatically apply the tax exemption to qualifying purchases. It’s a statewide policy, so stores don’t opt in or out.

Can I return items bought during tax-free weekend?

Yes, returns work like any other purchase. However, depending on timing, the refunded tax amount may vary or not apply if the return happens after the holiday ends.

What are the best back to school deals during tax-free weekend?

The best back to school deals include discounts on backpacks, notebooks, clothing, shoes, and tech like laptops and tablets. When combined with tax-free savings, many families can cut their spending by 10 to 20 percent.

What school supplies are included in tax-free weekend?

Most states include items like pens, pencils, folders, binders, crayons, calculators, and lunch boxes. Some states also include art supplies, headphones, and learning games under specific price caps.

When is tax-free weekend for back to school shopping?

Tax-free weekends for back to school typically happen in late July or early August, depending on your state. The window usually lasts 2 to 3 days, with some states offering longer events.

Can you buy back to school clothes during tax-free weekend?

Yes, most states include clothing and footwear under a certain price limit, usually around $100 per item. This covers jeans, shirts, jackets, school uniforms, and basic shoes.

Are backpacks tax-free during back to school weekend?

In many states, backpacks are considered a school supply and qualify for tax-free savings if under the price limit. Some states also allow rolling backpacks or book bags.

Can you buy laptops for back to school during tax-free weekend?

Yes, some states like Florida, New Mexico, and Missouri include laptops, tablets, and accessories under a specific price cap. This is a great time to buy tech for students heading to middle school, high school, or college.

Is back to school shopping cheaper during tax-free weekend?

Yes, shoppers can save both the state sales tax and take advantage of store discounts. When combined with coupons and cashback apps, the savings can really add up.

What should I buy during back to school tax-free weekend?

Focus on essentials like clothing, school supplies, and electronics that qualify under your state’s rules. It’s also a smart time to stock up on seasonal basics and everyday items for the school year.

🛒 Final Thoughts

Tax-free weekends are more than just back-to-school savings. With a little planning and a few free apps, you can stack serious value, especially if you’re outfitting a growing family or upgrading your home setup.

So plan ahead, know your state’s rules, and take advantage of every dollar you can keep in your pocket.

👉 Sign up for Rakuten, Ibotta, Fetch, or Upside, these bonuses alone can cover your lunch or gas next week.

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission. The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers. By using the affiliate links, you are helping support our Website, and we genuinely appreciate your support.

what do you think?

You must be logged in to post a comment.