15 Money Saving Challenges to Try In 2024

If you are looking for some motivation to save money, this is is the most complete guide with 15 savings challenges for the year! Saving money isn’t always the most exciting thing, one of the best ways to stay motivated to save is savings challenges! I am a very competitive person and if I can make a game out of saving money, it makes me work that much harder.

Today I’m sharing a FULL YEAR of savings challenges so you can do a new one each month plus a FREE bonus to do one throughout the year!

Before we jump in, WHERE you keep your savings is also very important. The best place to keep your savings is a high-yield savings account so that you can be earning interest on your money. CIT Bank offers record-breaking interest rates. Click here to open an account!

Check out this video for even more detail on these savings challenges!

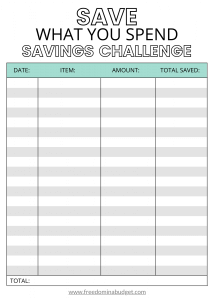

January: Save What You Spend Challenge

The Save What You Spend Savings Challenge not only helps you to save money but also stay accountable to your spending habits.

Here’s how it works: choose a spending category like eating out, personal spending money or clothing.

Then every time that you spend from that category you have to transfer the SAME amount to savings. For example, if you spend $11 on lunch with your coworkers then you also transfer $11 to your savings. If you can’t afford the $22 for lunch, then you don’t spend it!

February: One Month Ahead Savings Challenge

Saving one month of expenses may sound really hard, especially if you aren’t used to saving money… but it doesn’t have to be!

Use this easy printable to get One Month Ahead on your bills. Simply calculate your total monthly expenses, then divide that number by 30. Color in a calendar every time you save that amount.

Once all the calendars are all colored in you will have saved one month’s worth of expenses and be one month ahead on your bills!

March: Hello Spring Savings Challenge

The Hello Spring money-saving challenge printable. This useful finance printable will help you to gradually save $500 in a 31 day period. Save anywhere from $5 a day to a max of $20 that day.

After one month you will have a completed colored in tracker and $500 in the bank!

April: Homebrew Coffee Challenge

With the Homebrew Coffee Challenge, color in a mug every time you brew your own coffee at home. At the end of the month transfer $5 per cup to your savings or debt payoff!

May: $5 Dollar Savings Challenge

Handy Save $5 saving challenge printable. This useful finance printable will help you to gradually save $500 by saving every $5 bill you receive!

Saving over $500 may sound really hard, especially if you aren’t used to saving money. The $5 Bill Savings Challenge helps you to gradually save up the money to reach your goal of $500.

June: Vacation Savings Printable | 2 Options

Whether you are saving for a vacation at the beach, mountains, or abroad these 2 Vacation Savings Tracker Printables are just what you need to save for your next vacation. Both Vacation Savings Trackers are customizable for any amount you are saving for.

July: $1,000 In 30 Days Challenge

Saving $1,000 in 30 days is not for the faint of heart but it’s an awesome challenge if you are!

Everyday color in an icon and transfer that amount to your savings. At the end of the 30 days, you will have saved $1,000! (This can also be used for debt payoff as well!)

The best part about this challenge is the savings don’t have to go in order. If you have a day where you made a lot in tips or got a bonus at work you can tackle one of the higher savings days, and if you had a low day you can save as little as $5.

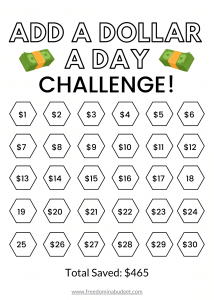

August: Add A Dollar A Day Savings Challenge

Add A Dollar A Day money saving challenge printable. This useful finance printable will help you to gradually increase your savings over a 30 day period (1 month). Use this tracker and save $465 in one month!

September: Don’t Break The Chain Savings Challenge Printable

Let’s take ‘Don’t Break The Chain’ up a level! Each day that you complete a habit/task mark an “X” in the corresponding date box. The goal is to not break the chain. If you don’t complete the month without breaking the chain then transfer the designated amount to your savings account.

October: Pantry Challenge

Are you ready for the Eat From The Pantry Challenge?! Food is the third-highest item in the average person’s budget, right below housing and transportation. Saving money on groceries is a really hard task for many but I’ve mastered the art of cutting out a little bit here and there to make a BIG difference in your budget. Check out my course on How To Save Money on Groceries here.

I bet if you really tried, you could skip going to the grocery store this week and find enough food to feed your family in your pantry, fridge, and freezer. When you are trying to cut your grocery budget for the month, challenge yourself to eat strictly from home.

Every week that you succeed color in a jar! After 4 jars are colored in, reward yourself! The reward could be a pizza night, a manicure, or simply a movie night at home!

November: Black Friday Savings Challenge

Black Friday money-saving challenge printable. This useful finance printable will help you to save for Black Friday. It is customizable for any amount you want to save

December: Holiday & Christmas Savings Printable

Start keeping track of your savings with these amazing Holiday and Christmas Savings Trackers. Get ready for the Holidays! Save for gifts, food, travel, décor, and of course your ugly Christmas sweater!

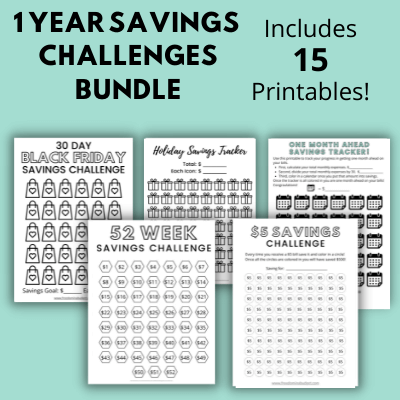

Get Them ALL! 1 Year of Savings Challenges Bundle

Want to try ALL the savings challenges? Get all 15 Savings Challenges in this bundle ($45 value!)

More Ways To Save:

Here at Freedom In A Budget, I am all about saving money! Here are some of the EASY ways that I save money:

• CIT Bank offers high interest savings accounts and CDs to provide a safe, secure way to earn money grow your savings.

• Fetch Rewards is a free grocery savings app that rewards you just for snapping pictures of your receipts. That’s really it. Free gift cards on groceries on thousands of products every day, no matter where you get your groceries. Just scan your receipts and get gift cards from places like Starbucks, Target, Ulta, Applebees. Use code QHKBH to earn 2,000 points ($2)!

• Rakuten/Ebates: Rakuten is my to go way to earn Cash Back from over 2,500 stores like Macy’s, Amazon, Sephora, Walmart and much more. Join Rakuten today for free, and you’ll get a $10 Cash Bonus to get you started! Every three months, you’ll get a Big Fat Check in the mail or a PayPal payment just for shopping.

• M1 Finance is an easy to use brokerage platform that allows you to invest in Fractional Shares and auto reinvest!

• Budget Templates: Excel budget templates with pre-populated categories and formulas to keep you on track with hitting your financial goals.

52-Week Savings Challenge

Handy 52-week money-saving challenge printable. This useful finance printable will help you to gradually increase your savings over a 52 week period (1 year). Use this tracker and save $1,378 in one year! – Saving over $1,300 in a year may sound really hard, especially if you aren’t used to saving money.

The 52-Week Savings Challenge helps you to gradually save up money. In the first week, you are only saving $1! Yep, that’s right, only $1! I know you can hit that goal! The following week you save $2, the week after $3, halfway through the year you are saving $26 that week until you get to the last week of the year and save $52. At the end, you will have saved $1,378!!

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission. The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers. By using the affiliate links, you are helping support our Website, and we genuinely appreciate your support.

what do you think?

You must be logged in to post a comment.