Unique Tips to Pay Off Credit Card Debt Quickly and Stay Debt Free

Debt has a way of creeping into every corner of life. It is not just the numbers on a statement, it is the stress you carry, the choices you delay, and the opportunities you miss because that balance is always hanging over you. For many people, it feels like a weight that never moves, no matter how many payments they make.

The problem is not that you are lazy or irresponsible. The real issue is that most of the advice out there is either too generic or too extreme. Cut out every little luxury. Stop buying coffee. Sell half your stuff. These tips might free up a few dollars, but they rarely lead to lasting change, and they certainly do not make you feel empowered along the way.

If you want to pay off debt fast, you need strategies that are practical, creative, and built for real life. You need methods that not only move the needle on your balance but also change the way you think about money. This is where unique approaches like savings challenges, mindset shifts, and credit card strategies come in.

In this article, we will look at both the traditional methods that have helped countless people pay down debt and the fresh ideas that go beyond the basics. By the end, you will have a toolkit of strategies that fit your life, keep you motivated, and most importantly, get you out of debt faster than you thought possible.

👉 Click here to watch: How To Pay Off Credit Card Debt FAST [Easy Steps You Can Take Today]

Why Credit Card Debt Should Be Your First Target

Not all debt is created equal. Mortgage payments or student loans may feel heavy, but credit card debt is in a different category altogether. The reason is simple: interest rates.

Most credit cards carry rates of 18 percent, 22 percent, or even higher. That means for every hundred dollars you owe, the balance can grow by almost twenty dollars a year if you only make minimum payments. Compare that to a car loan at five percent or a mortgage at six percent, and you see why credit cards are the most dangerous form of debt.

Credit card debt is also sneaky. Minimum payments are designed to keep you stuck. You may pay faithfully each month, but the balance hardly moves because so much of your payment goes to interest instead of principal. That cycle can stretch for decades if you let it.

There is also the emotional weight. Carrying credit card debt feels different because it is tied to everyday spending. It is not about a home or an education, it is about groceries, gas, clothes, and restaurants. That makes it harder to justify, and it often comes with guilt. The longer it lingers, the heavier it feels.

This is why tackling credit card debt first is critical. Every dollar you throw at it is like buying freedom from one of the highest financial traps out there. Once the cards are gone, the money you free up can be redirected to other debts or to building savings. The relief is immediate, and the momentum it gives you is priceless.

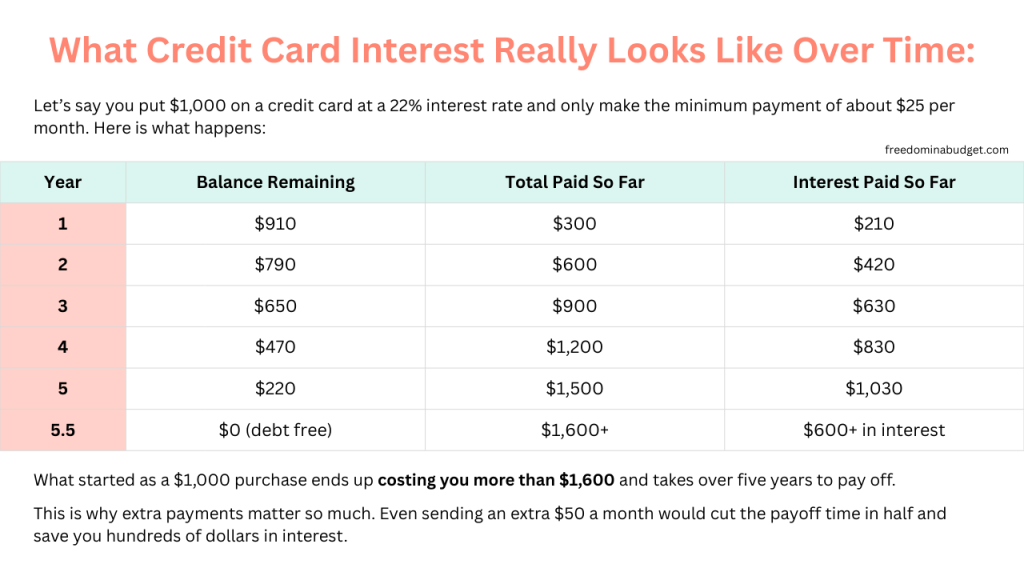

The Reality of Credit Card Interest

One of the biggest reasons people stay stuck in debt is because they underestimate how much interest adds to the cost of everyday purchases. A swipe for $100 might not feel like a big deal, but once interest is added, that item can end up costing much more than you realize.

Imagine this. You put $1,000 on a credit card with a 22 percent interest rate and only make the minimum payment of about $25 a month. At that pace, it will take you more than five years to pay off the balance, and you will spend over $600 just in interest. That $1,000 purchase really costs you $1,600.

Here is another example. You spend $200 on new clothes and make only minimum payments of around $10. With a 22 percent interest rate, it will take you almost two years to pay it off. By the time it is gone, you will have paid about $80 in interest. Those clothes actually cost you $280.

Even small balances can trap you. A $50 dinner put on a card and left unpaid for a year at 22 percent interest turns into $61. That might not sound like much, but when you multiply it across dozens of purchases, the total climbs fast.

This is why credit card debt feels like quicksand. You keep making payments, but the balance hardly moves because so much of your money is going toward interest. The longer it sits, the more it grows. Understanding this math is not meant to scare you, it is meant to show you that the faster you act, the less money you waste on interest. Every extra payment is like buying your freedom back at a discount.

Start With a Budget and Track Your Spending

Every debt payoff journey begins with one simple step: knowing where your money is going. Without a clear budget, it is like trying to drive without a map. You might move forward, but you will waste time and fuel along the way.

The first time you sit down to track your spending, it can feel overwhelming. You might see dozens of transactions across different accounts and feel like it is too much to handle. But here is the good news. Once you build the habit of checking in every couple of days, the process gets quick. Most people find it takes no more than ten minutes to update their budget and stay on top of spending. That small amount of time pays off in a big way, because it gives you control and clarity.

The key is consistency. When you know what is coming in and what is going out, you can decide where to cut, where to save, and how much to send directly to debt. This is where the right tools make all the difference. My Budget Spreadsheet is a simple and effective way to lay out your income, bills, and goals so you always see the big picture. If you prefer apps, programs like Rocket Money can automate the process, track your expenses in real time, and even flag subscriptions you may have forgotten.

Whether you use a spreadsheet or an app, the goal is the same. Give every dollar a job. When you are clear on where your money is going, you are no longer guessing. You are making decisions that move you closer to debt freedom.

Free Up Cash Fast With a 7 Day Challenge

One of the biggest struggles when paying off debt is simply finding extra money in the budget. You may feel like every dollar is already spoken for, but often there are hidden leaks and overlooked opportunities that can free up cash quickly.

That is exactly why I created my 7 Day Find $500 in Your Budget Challenge. Over the course of one week, I walk you through simple but powerful steps to uncover money you did not realize was there. From spotting subscriptions you forgot about, to tightening grocery spending, to small tweaks in daily habits, these changes add up fast.

The goal is not to cut out everything you love. It is about getting creative and intentional with the money you already have. Most people who go through the challenge are shocked at how much they can free up without feeling deprived.

Imagine finding an extra $500 in just one week and sending it directly toward your debt. That is the kind of momentum that makes paying off debt feel possible. It shows you that progress is not about massive sacrifices, it is about making small but smart adjustments consistently.

👇 Join below and get Day 1 and the free PDF guide 👇

Why Budgeting Matters When You Feel Overwhelmed

When you are buried in credit card debt, the last thing you want to do is sit down with numbers. Budgeting can feel like one more heavy task on top of an already overwhelming situation. But here is the truth. If you have never worked with a budget, it might actually be the missing piece that gives you back control.

Without a budget, most people only know their rent or mortgage amount. Everything else just slips through the cracks. That is why debt feels endless. If you do not know where your money is going, you cannot redirect it toward your goals. The problem is not always income. It is often untracked spending that quietly adds up.

Budgeting is not about cutting out everything you enjoy. It is about awareness. When you track what comes in and what goes out, you start to see opportunities. Maybe it is unused subscriptions, impulse spending, or a grocery bill that crept higher than you realized. The moment you spot those leaks, you can plug them and send the savings straight to your debt.

The good news is that budgeting does not have to be complicated. Once you get into the habit of updating your numbers every few days, it only takes about ten minutes. To make it easier, you can use my Budget Spreadsheet, which gives you a clear and simple way to see your income, bills, and goals in one place. Or, if you prefer an automated option, apps like Rocket Money can track your spending and even flag subscriptions you forgot you had.

Budgeting is the first step to changing the narrative from “I am drowning” to “I am in control.” When you know where your money is going, you can decide where it should go, and that is the foundation of paying off debt for good.

💡 Quick Pep Talk

Starting a budget feels scary, but it is not as bad as your brain is making it out to be. You already know how to check your bank account, so you are halfway there. All you need to do is write those numbers down and give them a plan. The first time takes a little effort, but once you get into the rhythm, it only takes minutes. Remember, a budget is not a punishment. It is a tool that shows you what is possible. One small step today can give you the peace of mind you have been missing.

Ways to save!

- CIT Bank: BEST High-yield savings account; your bank shouldn’t be charging you money. Instead, YOU should be making money off your money!

- AURA: All-in-one digital safety to help protect you from identity theft, financial fraud, and online threats. Try AURA for 14 Days for FREE today and get 3 Bureau Credit Monitoring, Credit Lock, Antivirus, Secure VPN, Transaction Monitoring, Identity Protection, Parental Controls and 24/7 US-Based Customer Support.

- Lantern: Get a quick, free quote on term life insurance, affordable, online term life insurance. No exam! No waiting! No hassles!

- Upside: Earn 20 cents per gallon on gas cash back when you download the app.

- Fetch Rewards is a free grocery savings app that rewards you just for snapping pictures of your receipts. That’s it. Really. Free gift cards on groceries on thousands of products every day, no matter where you get your groceries. Just scan your receipts and get gift cards from retailers like Target, Ulta, Applebees.

- Rakuten: Get cash back on online purchases and automatic coupons and savings with their browser plugin… and remember, you have to make a $30 purchase to get your $30 for free!

- Build Wealth by Investing in Index Funds Course: I’ve teamed up with my friend Jeremy from Personal Finance Club to teach you everything you need to know to invest in index funds! How to open an account, how much to invest, and how to choose an index fund. You’ll gain the knowledge and confidence to optimally invest and build wealth for decades.

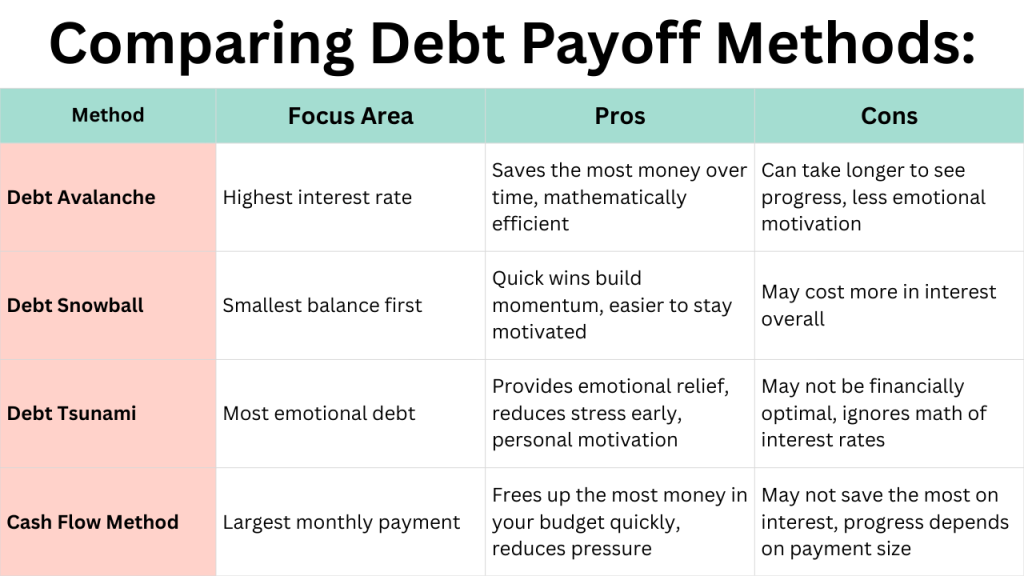

Choosing the Right Debt Payoff Method

There is no one size fits all when it comes to paying off debt. The right method is the one that keeps you motivated and consistent. Here are four proven approaches you can choose from.

Debt Avalanche Method

The avalanche focuses on interest. You start with the debt that has the highest interest rate while making minimum payments on everything else. Once that is gone, you move to the next highest. It saves you the most money over time, but it can take longer to feel progress.

Debt Snowball Method

The snowball focuses on momentum. You start with the smallest balance first, regardless of the interest rate. Once it is paid off, you roll that payment onto the next balance. The quick wins keep you encouraged, even if you pay a little more in interest overall.

Debt Tsunami Method

The tsunami focuses on emotions. You start with the debt that causes you the most stress or frustration, no matter the size or interest rate. Tackling the most painful balance first gives you relief and energy to keep going.

Cash Flow Method

The cash flow method focuses on freeing up money in your budget. You start with the debt that carries the largest monthly payment. Once it is gone, you immediately have more breathing room in your budget, which reduces financial pressure and gives you a big monthly amount to throw at the next debt.

No matter which method you choose, the most important part is sticking with it. Debt payoff is not about perfection, it is about progress. Pick the strategy that feels the most sustainable for your personality and financial situation, then commit to it until you see results.

👉 Watch this video: The FOUR best ways to pay off debt

Boost Your Income to Pay Off Debt Faster

Cutting expenses is powerful, but there is only so much you can trim. At some point the fastest way to pay off debt is to bring in more income. Even a small amount makes a big difference. An extra two hundred dollars a month turns into twenty four hundred dollars over the course of a year, all of which can go straight toward your highest interest balances.

The good news is you do not need a second full time job to make it happen. There are flexible side hustles that fit into everyday life and schedules. Some of the best starting points include offering virtual assistant services, simple bookkeeping, selling digital products, and coaching others in areas you already know well. These are real opportunities that can be started quickly and scaled over time.

If you want step-by-step guidance, my FREE Side Hustle Guide is a free resource that helps you find the right idea for your life stage and start bringing in income right away. When you pair extra cash with a strong budget, you create real momentum. Instead of only cutting back, you are moving forward, building skills, and paying off debt faster than you thought possible.

👇 Want practical side hustle ideas you can start quickly? Grab my free Ultimate Side Hustle Guide and find the right fit to bring in extra income fast. 👇

Why Challenges Work for Paying Off Debt

There is a reason savings challenges are so popular. They turn an overwhelming goal into something simple, structured, and even fun. Instead of telling yourself you need to save thousands, a challenge breaks it down into small, daily or weekly steps that feel manageable. Every time you complete one of those steps, you get a little hit of accomplishment that motivates you to keep going. That is the psychology behind why challenges work so well.

Now imagine taking that same concept and applying it to debt payoff. Instead of saving the money in an account, you send it straight to your credit card balance. You get the same satisfaction of watching your progress add up, but with the added benefit of lowering interest charges and getting closer to freedom.

When you frame debt repayment as a challenge, it stops feeling like a punishment and starts feeling like a game you can win. You are no longer just cutting back, you are completing a mission. That shift makes the process more sustainable and far more motivating.

👉 Click here to watch: 5 EASY Savings Challenges in 2025 | Easy Ways To Save THOUSANDS $$

👉 Read the article: ULTIMATE List of EASY Savings Challenges That Will Help You Save THOUSANDS [FREE PRINTABLE]

Pay Off What You Spend Debt Challenge

If you want a challenge that makes you think twice before swiping your card, this one is powerful. The Pay Off What You Spend Debt Challenge means that every time you make a purchase in a specific category, you must make a matching payment to your debt.

For example, if you spend $15 on lunch with friends, you send another $15 to your credit card balance. Suddenly that lunch really costs $30. If you cannot afford to cover both, you skip it. This rule forces you to pause, reconsider, and get honest about whether the purchase is worth it.

What makes this challenge so effective is that it connects spending and debt in real time. Instead of waiting until the end of the month, you are constantly reminded of how every purchase impacts your progress. It builds discipline, keeps your debt from growing, and accelerates your payoff at the same time.

You can run this challenge for one month in a single category like eating out or clothing, or you can go all in and apply it to every swipe. Either way, you will see results quickly, not just in your balance, but in how mindful you become about money.

👇 Grab the printable below for free 👇

Redirect Subscription Cuts Toward Debt

One of the easiest ways to free up money is by cutting subscriptions you no longer use. The mistake most people make is canceling and then letting that money quietly disappear into other spending. To make real progress, you need to redirect those savings straight to your credit card balance.

For example, if you cancel a $20 streaming service, set up an automatic $20 transfer to your card every month. The money was already leaving your account, so you will not miss it. The difference is that now it is shrinking your debt instead of paying for something you no longer value.

Apps like Rocket Money make this process simple. They scan your accounts for subscriptions, flag forgotten charges, and help you cancel with a few clicks. Many people are shocked at how much money they free up when they see every subscription laid out in one place.

Each cancellation might not feel like much on its own, but when you stack them together, the extra payments add up fast. Redirecting those cuts ensures you are not just saving money, you are actively building momentum toward debt freedom.

Also check out these articles:

EASY Savings Challenges That Will Help You Save THOUSANDS [FREE PRINTABLE]

Saving money isn’t always the most exciting thing, one of the best ways to stay motivated to save is savings challenges! I am a very competitive person and if I can make a game out of saving money, it makes me work that much harder.

Today I’m sharing the ultimate list of savings challenges that will keep you pushing for more resulting in great returns!

In Season Produce by Month | How To Save Money On Groceries

Fresh fruits and vegetables can get expensive. One big way to save money is by buying your produce when it is in season.

Produce grows best at different times of the year depending on what type of fruit or vegetable it is. When you buy your produce during that time, it will save you money rather than the stores having to ship it in from another part of the country or world.

Operation Christmas Child Shoebox Ideas & How To Pack a Shoebox

Operation Christmas Child, a project of Samaritan’s Purse, delivers shoebox gifts filled with toys, hygiene items, and school supplies to children in need around the world. It’s a meaningful way for individuals, families, and churches to come together and spread the love of Jesus. Each shoebox is a simple but powerful gift, and for many children, it may be the first one they have ever received.

If you’re wondering how to pack a shoebox, what to put in an Operation Christmas Child shoebox, or need creative shoebox gift ideas by age or gender, this guide will walk you through it all. You’ll find step-by-step tips, approved items, and helpful suggestions for making your box both fun and practical. One shoebox can start a ripple effect of hope that reaches entire families and communities.

Credit Cards Are Not Your Emergency Plan

Credit card companies have spent decades convincing people that their card is a safety net. “Keep it for emergencies,” the ads said. It sounds practical, but the truth is this was always a marketing scam. Their goal was not to protect you. Their goal was to make sure that when life got stressful, you turned to a product that earns them money through high interest rates.

Think about what happens when you use a card for an emergency. A $400 car repair becomes $500 or more once interest is added, and if you cannot pay it off quickly, that balance lingers for months or even years. Instead of solving the problem, you created another one.

A real emergency plan is cash. Even a mini emergency fund of $500 to $1,000 gives you breathing room so you do not have to swipe when something goes wrong. Over time, aim for three to six months of expenses. The key is to keep this money separate from your checking account so you are not tempted to spend it.

The best place to store an emergency fund is in a high yield savings account. That way your money is safe, accessible, and earning interest while it waits. Unlike credit card debt, which grows against you, a savings account grows for you. Two excellent options to consider are CIT Bank and Ally Bank, both of which offer competitive interest rates and easy online access.

Here is the bottom line. Your emergency fund protects you. Your credit card protects the bank. Build the fund, keep it in a high yield account, and you will never again have to rely on debt in a crisis.

The Zero Leftover Rule

Most people breathe a sigh of relief if they have a little money left over at the end of the month. They think of it as a safety net. The problem is, that leftover cash almost never stays untouched. It gets eaten by late night takeout, a quick Amazon order, or the little splurges that feel harmless but quietly add up.

Here is the truth: a buffer in your checking account is not a debt strategy. It is a leak in your plan. If you really want to pay off debt fast, you need to treat every extra dollar with purpose.

The Zero Leftover Rule means this: when the month ends and you reconcile your budget, every single penny that did not get spent goes directly toward debt. You do not let it linger in checking, you do not roll it over into the next month, you do not treat it as fun money. You sweep it straight into debt repayment.

Why does this work? Because a buffer is not protection. Emergencies should be covered by an emergency fund. Your budget should already account for bills and true expenses. If you rely on a leftover buffer, you are just giving yourself permission to drift. But when you commit those dollars to debt, you create discipline, you build momentum, and you shorten the timeline to freedom.

It is not about perfection. Some months you may only have five or ten dollars to roll over. That still matters. Each transfer reminds you that you are in charge of where your money goes. And the more consistent you are, the faster those small amounts snowball into real progress.

Mindset Shift: Why Buffers Hold You Back

When it comes to money, most people think a small leftover balance in their checking account means they are being responsible. They call it a buffer. It feels like security, but in reality it is a trap. That buffer does not protect you, it simply creates a false sense of comfort.

Here is what usually happens: you leave $200 or $300 unassigned in your account. You tell yourself it is there “just in case.” By the end of the month, that money quietly disappears. A dinner out here, a late night online order there, and suddenly the buffer is gone without actually helping you move forward.

If you want to pay off debt fast, you have to think differently. That is where the Zero Leftover Rule comes in. At the end of every month, after you reconcile your budget, sweep every remaining dollar to debt. Even if it is just $20 or $50, it counts. You do not roll it over, you do not let it sit, you give it a job.

The truth is, emergencies should come from an actual emergency fund, not a vague leftover balance. Your budget should already be covering the essentials. By sending every extra penny to debt, you stop drifting and start directing. It is a powerful shift from passive to intentional.

This approach is not about deprivation. It is about clarity. Instead of waiting and hoping that debt goes down, you are actively pushing every single month. That mindset of urgency is what makes the difference between paying off debt in five years versus three.

Stop Overspending by Treating Yourself Like an Adult

One of the most common money problems is untracked spending. Many people know their rent or mortgage amount, but when you ask how much they spent on food, shopping, or subscriptions last month, the answer is a shrug. This is where debt quietly builds, because money that is unaccounted for almost always disappears.

If you want to pay off credit card debt, you have to start treating yourself like an adult with your money. That means looking at your purchases, not just your balances. Every swipe, every click, every little “it’s only $10” choice adds up. Ignoring where your money goes is like leaving the faucet running and wondering why the water bill is so high.

This is where the Zero Leftover Rule becomes powerful. Instead of letting extra money sit in your account as a so-called buffer, sweep every last dollar toward your debt at the end of the month. A leftover balance is not protection, it is wasted opportunity. Emergencies should come from an actual emergency fund, not from drifting dollars in checking.

If you are not sure where to start, my 7 Day Find $500 in Your Budget Challenge is a simple way to uncover spending leaks you did not even realize were there. Most people who go through it are shocked at how quickly small adjustments add up to real money they can send directly toward debt.

The truth is simple. Adults take responsibility for where their money goes. When you do the same, you stop overspending by accident and start making every dollar work for you instead of against you.

What to Do If You Feel Defeated

Debt has a way of making you feel like you are stuck in quicksand. Maybe you have too many variables, different cards, zero interest offers, medical bills, or unexpected expenses, and you do not know where to start. That feeling of defeat can be heavier than the debt itself.

Here is the truth. You do not need to solve everything at once. Trying to tackle every balance and every habit in the same week will only keep you paralyzed. Instead, pick one clear action to focus on. It could be choosing your payoff method, setting up a mini emergency fund, or even just tracking your spending for the first time. One step breaks the cycle of doing nothing.

When I paid off my student loans, I did not do it overnight. I went hard, yes, but it started with small and consistent choices that built momentum. Each time I saw progress, no matter how small, it gave me energy to keep pushing. You can do the same.

If you feel overwhelmed, start with something simple like my 7 Day Find $500 in Your Budget Challenge. It gives you quick wins that prove progress is possible. Once you see that, the weight of defeat starts to lift.

Debt payoff is not about perfection. It is about direction. The goal is not to fix everything today, but to start moving forward. Every small win matters, and the more you stack them, the closer you get to the freedom you want.

Paying Off Your Debt Doesn't Have to Be Complicated

One reason many people give up on paying off credit card debt is because it feels too complicated. They read about different payoff methods, calculators, or advanced strategies and end up stuck in analysis instead of action. The truth is that debt payoff does not have to be complicated.

At its core, there are only two things you need to do:

- Stop adding new debt

- Pay more than the minimum.

That alone guarantees progress. Everything else, such as whether you choose snowball, avalanche, tsunami, or cash flow, just changes the order, not the outcome.

Do not get distracted by thinking you need the perfect system. A simple plan done consistently will always beat a complicated plan that you abandon. The goal is not to master every strategy, it is to start moving.

Debt freedom comes from progress, not perfection. Keep it simple, stay consistent, and you will get there.

Pair Debt Payments with Daily Habits

One of the most effective ways to make progress on debt is to connect it to habits you already do every day. The brain loves patterns, and when you link debt payoff to a routine, it stops feeling like an extra chore and starts becoming automatic.

This approach lines up perfectly with the principles from James Clear’s book Atomic Habits. He explains that small, consistent actions compound over time and create powerful results. By tying debt payments to something you already do, you create a habit loop that is both simple and rewarding.

Here is how it works. Every time you complete a regular task, you send a small amount toward your credit card debt. After each workout, transfer $10. When you finish a load of laundry, send $5. After reading a chapter of a book, pay $2. The dollar amounts are small enough to feel manageable, but because you do these activities often, the payments add up quickly.

This method is powerful because it blends discipline with reward. The habit itself gives you a sense of accomplishment, and pairing it with a payment doubles the feeling of progress. Instead of waiting until the end of the month to see results, you are building momentum every single day.

Over time, these small, steady transfers can add up to hundreds of dollars going toward your balance without feeling forced. It is a creative way to keep debt payoff front and center while also building habits that make you feel proud and in control.

Try a Debt Sprint for Fast Results

Paying off debt can feel like running a marathon, but sometimes a sprint is exactly what you need. A debt sprint is a short period of intense focus where you cut spending to the bone, work extra hours, or sell unused items, and push every extra dollar toward your balance. The goal is not to live this way forever, but to create a surge of progress in a short time.

Short-term sacrifice brings long-term peace of mind. When you go all in for thirty or sixty days, you can knock out a smaller balance completely or make a serious dent in a larger one. That win builds momentum and frees up cash for the next step.

I know this works because I lived it. I went so hard in paying off my student loans, cutting back on extras and throwing everything I had at them. It was not easy in the moment, but it was temporary. Now I am debt free, I have discretionary income to spend how I want, and the weight of debt is completely off my shoulders. That peace of mind is worth far more than anything I gave up in the short term.

Debt sprints are powerful because they show you what is possible when you get focused. Even one sprint can shift your mindset and prove that freedom is within reach. And once you taste that progress, it becomes easier to keep pushing forward.

Pay More Often Than Monthly

Most people make just one payment a month on their credit cards, usually right before the due date. The problem is that interest accrues daily, which means your balance sits higher for longer and costs you more over time.

By making smaller payments throughout the month, even if it is just once a week or every time you get paid, you keep your balance lower more consistently. This reduces the amount of interest that builds and helps you save money. It also improves your credit utilization ratio, which can have a positive effect on your credit score.

For example, instead of paying $400 once a month, try making four payments of $100. The total paid is the same, but the balance stays lower, and the interest charged is less. The math works in your favor simply because of timing.

This method is especially helpful if you struggle with overspending. Sending payments more often creates accountability, because the money leaves your account before you have a chance to use it for something else.

Over time, these frequent smaller payments make a noticeable difference. You save on interest, you see progress faster, and you train yourself to treat debt payoff as a regular part of your money routine instead of a once-a-month event.

How Extra Payments Actually Work

One of the most common questions people have is what happens when you pay more than the minimum on your credit card. Many worry that the extra money will not go toward the balance unless they call the company or label it as principal only. The good news is that you do not need to jump through extra hoops.

When you make a payment, the credit card company applies it first to interest and fees, then to your balance. That means when you pay only the minimum, almost all of it goes to interest. When you pay more than the minimum, the additional amount is automatically applied to the principal balance. This is where progress happens, because reducing the principal is what lowers future interest charges.

Here is an example. Imagine your minimum payment is $100 and you decide to pay $300. The first $100 covers the minimum, which includes interest and fees, and the remaining $200 goes directly toward your balance. You do not need to call the company or make two separate payments.

If you want to be extra cautious, you can log into your online account and check the payment history to confirm that the balance is shrinking. Some companies even show a breakdown of how much went to principal versus interest.

The key takeaway is simple. Every extra dollar you send reduces your balance and speeds up your payoff. Even small amounts, like an extra $20 here or $50 there, chip away at the debt faster than you realize.

Put All Income Increases Toward Debt

One of the fastest ways to accelerate debt payoff is to treat every raise, bonus, or refund as if it never happened. Instead of folding that money into your lifestyle, send it directly to your credit card balance. Since you were already living without it, you will not feel the loss, but your debt will shrink much faster.

For example, if you receive a $1,000 tax refund, resist the temptation to splurge and apply the full amount to your highest interest card. If your employer gives you a $200 monthly raise, set up an automatic transfer for that same $200 toward debt. Over time, these boosts add up to thousands of dollars saved in interest and months or even years shaved off your repayment timeline.

This method works because it removes lifestyle creep. Many people increase their spending the moment their income goes up, which keeps them stuck in the cycle of working harder but never feeling ahead. By committing every increase to debt, you break that cycle and give yourself a real shot at long-term freedom.

Every time your income goes up, see it as an opportunity to speed up the journey to being debt free. The sooner the debt is gone, the sooner you can enjoy those income increases for yourself instead of handing them to the credit card companies.

Rapid Fire Tips for Paying Off Credit Card Debt

What is the fastest way to pay off credit card debt?

The fastest way is to combine extra payments with a structured plan like the debt avalanche or debt snowball. Adding creative challenges such as paying every time you swipe or redirecting subscription savings can speed up results even more.

Should I pay off my smallest credit card first or the one with the highest interest?

It depends on your goals. Paying the smallest card first through the snowball method builds momentum with quick wins, while paying the highest interest card first through the avalanche method saves you the most money in the long run.

How can I pay off credit card debt without feeling deprived?

You can pay off debt without feeling deprived by using creative strategies that feel like games instead of punishments. Pair habits with small payments, try a debt sprint for one month, or redirect canceled subscriptions so progress feels motivating rather than restrictive.

Why is credit card debt so hard to pay off?

Credit cards often carry interest rates above 20 percent. When you only make minimum payments, most of your money goes toward interest instead of the balance, which keeps you stuck in the cycle of owing.

Can I really pay off debt with small changes?

Yes. Sending $5 or $10 toward your balance every few days reduces interest and builds momentum. Over months, these small consistent actions create hundreds of dollars in progress and keep you motivated.

Should I use my credit card for emergencies?

No. Credit cards are not an emergency plan, even though they were marketed that way. A better option is to build a mini emergency fund of $500 to $1,000 in a high yield savings account so you can handle surprises without adding debt.

Is it better to pay off credit cards once a month or multiple times?

Making multiple smaller payments throughout the month is better than one large payment at the end. It keeps your balance lower, reduces daily interest charges, and improves your credit utilization ratio.

What apps can help me pay off credit card debt?

Apps like Rocket Money can track spending, cancel unused subscriptions, and help you redirect savings to your card. Budgeting spreadsheets or expense-tracking tools can also keep you consistent.

How can side hustles help me pay off credit card debt faster?

A side hustle creates extra income that can be sent directly to debt. Virtual assistant work, simple bookkeeping, or selling digital products are flexible options that fit into your life and accelerate progress without relying only on cutting expenses.

What is the best debt payoff method for peace of mind?

If stress is your biggest concern, the debt tsunami method is often best because it tackles the debt that weighs on you emotionally. For some, the cash flow method also provides peace by eliminating the largest monthly payment first, freeing up breathing room quickly.

How Extra Payments Actually Work

Someone asked whether you need to call the credit card company to apply extra money to principal. This could be a clarifying section on how payments are applied (minimum first, then extra toward balance) and when it might make sense to call the issuer to confirm.

Ready to Finally Feel In Control of Your Money?

If you’ve been struggling with budgeting, you’re not broken. You probably just haven’t found a system that works for you.

👉 Grab my Budget Spreadsheet + Printable Toolkit if you want something simple, easy to use, and designed to keep you motivated.

👉 Check your subscriptions with Rocket Money and start freeing up cash today.

👉 Set up a CIT Bank high-yield savings account so your money grows while you sleep.

👉 Use Rakuten to earn cash back on purchases you were going to make anyway.

👉 Download the Impulse Spending Checklist and Side Hustle Guide to help build better habits and increase your income.

You don’t have to do everything perfectly. You just need to start.

Your future self is already thanking you.

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission. The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers. By using the affiliate links, you are helping support our Website, and we genuinely appreciate your support.

what do you think?

You must be logged in to post a comment.